Designed to support the delivery of essential services to Oak Park community members, while also advancing several key priorities and initiatives laid out by the Village Board, the municipal budget for 2024 is comprised of numerous separate funds totaling $186.6 million in expenditures, excluding interfund transfers.

Each fund is dedicated to supporting a particular type of outlay, which is typically defined under the Governmental Accounting Standards Board or State of Illinois and local laws.

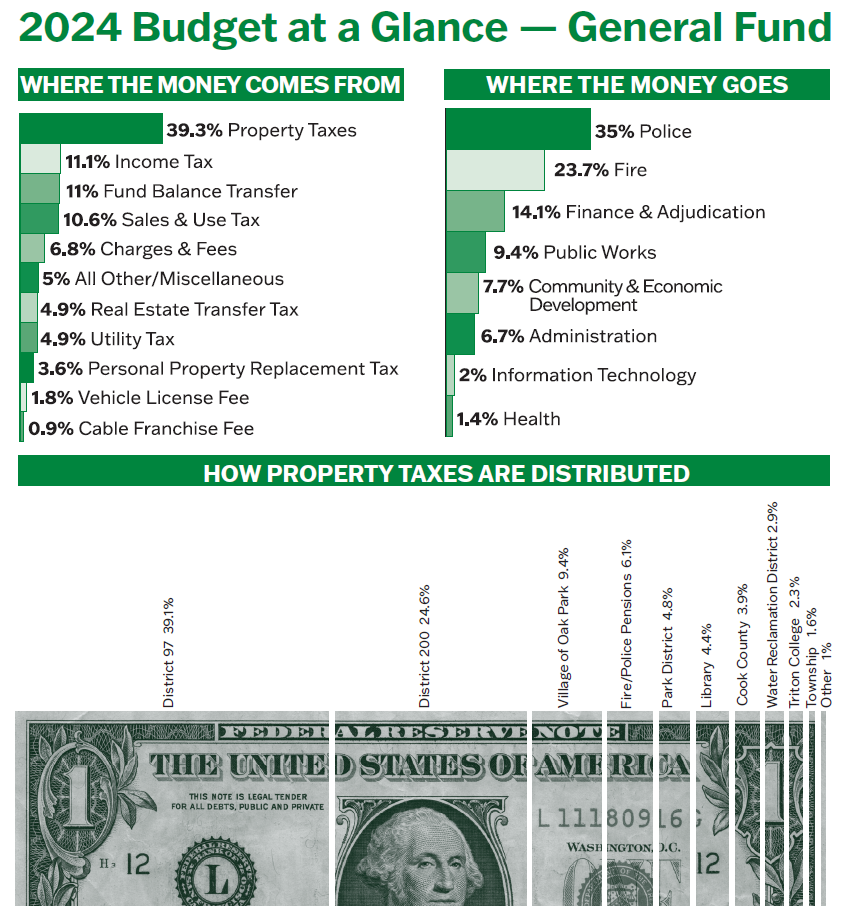

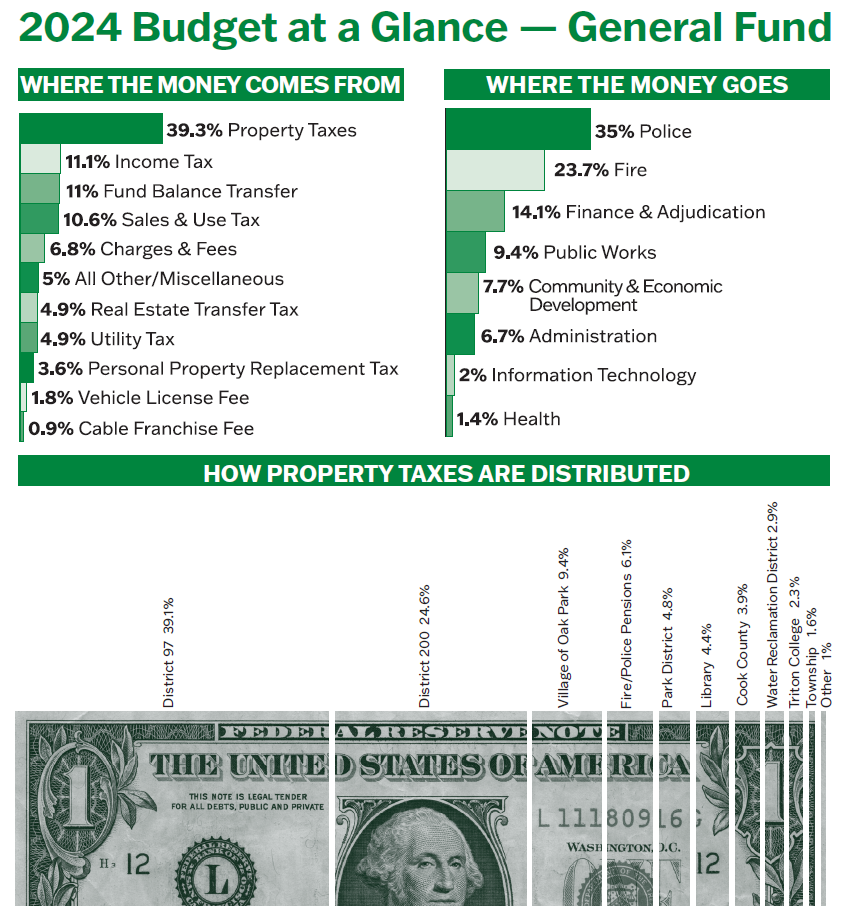

The most substantial of these separate funds is the $73.3 million General Fund. This fund aids most day-to-day municipal operations that are critical to the community’s quality of life, such as public works and public safety services like roadway maintenance and emergency response. Municipal expenditures from the General Fund are supported by several sources, including property taxes, sales taxes, utility taxes, real estate transfer taxes and user fees.

Property taxes are the largest contributor to General Fund expenditures in 2024 at about 39%. Based on current available data, approximately 15.5% of an Oak Park property owner’s tax bill goes toward funding the Village’s municipal services and State-mandated Police and Fire pensions.

For the 2024 municipal budget, $6.1 million will be transferred from the Village’s fund balance to accelerate Oak Park’s capital improvement plan. The maneuver allows the Village to avoid issuing debt for the third consecutive budget cycle and is made possible because of the Village’s significant reserve fund balance that is presently around 45%, exceeding the recommended proportion of 25%.

A large portion of that money, $5.8 million, is marked for one-time and non-recurring expenses in the year ahead. Some of these significant items include a pilot program for Oak Park’s alternative response to calls for service, the development of a strategic plan related to economic vitality, long-term financial planning, a review of the Citizen Police Oversight Committee (CPOC), the community’s broadening language access needs and more. Only $300,000 is budgeted from that transferred amount to support day-to-day operations.

There is a variance of more than $600,000 in the property tax levy as that number remained flat this year. The Board previously approved increasing the property tax levy 3% from the tax year 2022 levy. The police and fire pension levy and debt service increases, and the corporate (general operations) levy decrease, attribute to the primary increase to the Village’s levy.

More than 58% of the Village’s general fund allocations in 2024 are directed to support the Village’s Police and Fire departments. The dedicated men and women who staff these areas are highly trained to serve and protect Oak Park around the clock every single day.

A bit more than 9% of all 2024 General Fund dollars will be directed to the Village’s Public Works Department. This devoted unit oversees the maintenance of 100 miles of Village-owned streets, 500 alleys, 18,000 parkway trees, 7,000 lighting fixtures, 104 miles of water mains, 110 miles of sewer mains, eight miles of bicycle lanes and some 4,000 public parking spaces.

Refuse rates were held flat for 2022 and 2023, though the rates for Lakeshore Recycling services (LRS) waste hauling services increased by 5% this year per contract. The LRS rates are expected to increase by 4.3% in 2024. The Village is currently in the second year of a five-year agreement with LRS, which provides refuse, recycling and yard-waste collection and disposal to owners of residential property containing five units or less. The monthly rates paid by residents in 2024 are set to increase by 4%; a 96-gallon cart will increase from $29.06 per month in 2023 to $30.22 next year, while a 64-gallon cart adjusts from a monthly cost of $26.39 to $27.45. Yard waste and refuse stickers will be $3.25 in 2024. Approximately 45,000-yard waste and 30,000 refuse stickers are sold annually.

Water and sewer rates will increase 4% in 2024, as well, in order to maintain a sufficient fund balance for the Village’s Water & Sewer Fund. American Water Works Association recommends an operating reserve of 25% of the annual operating expenses. For Oak Park, that approximately equates to an operating reserve balance goal of $2-3 million.

Information on the budget process and copies of the Fiscal Year 2024 and past year’s budgets are available at www.oak-park.us/budget.