The municipal budget for 2020 focuses resources on enhancing public safety and delivering essential services, while continuing to ensure fiscal stability.

The 2020 budget is comprised of 34 funds and $168.6 million in expenditures, excluding interfund transfers.

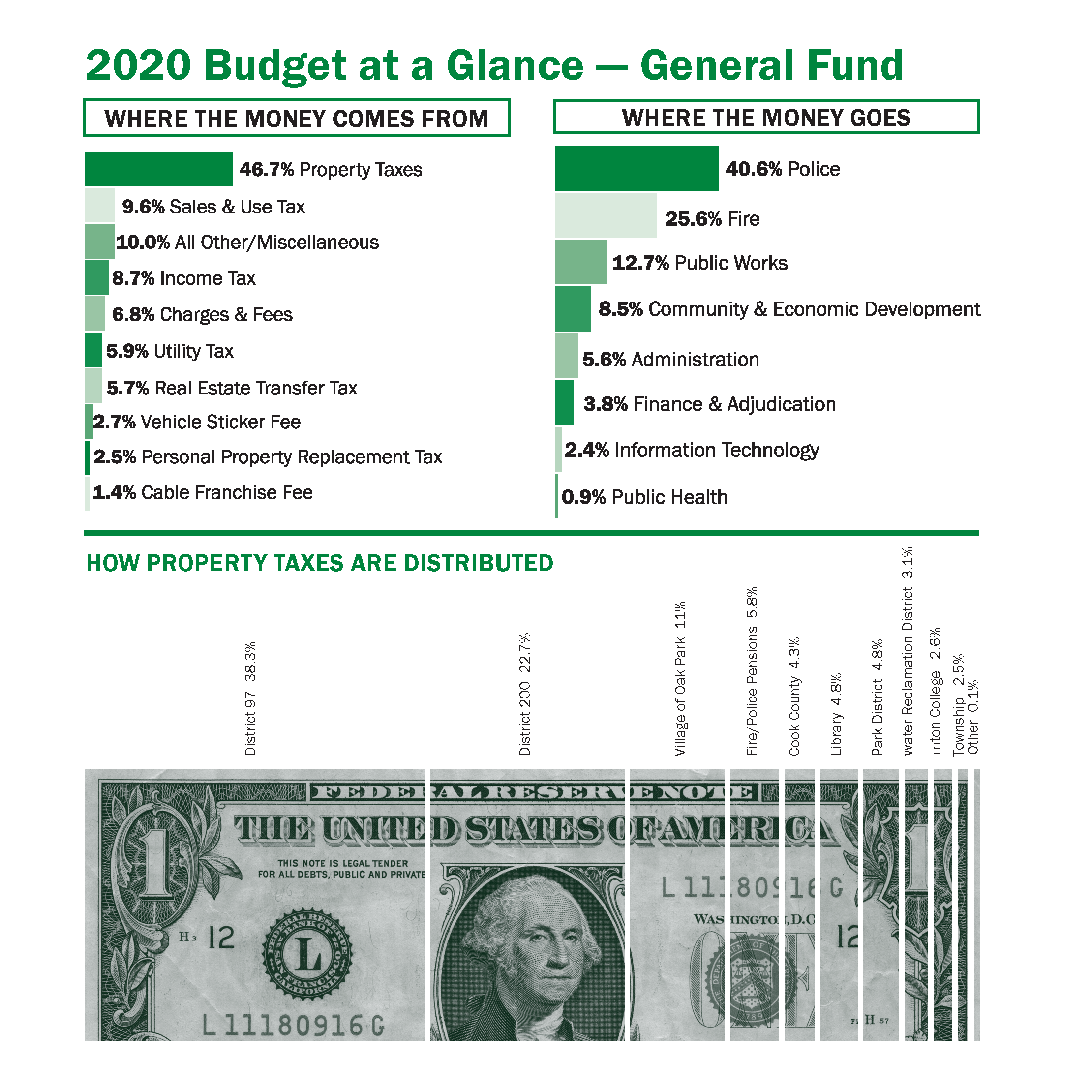

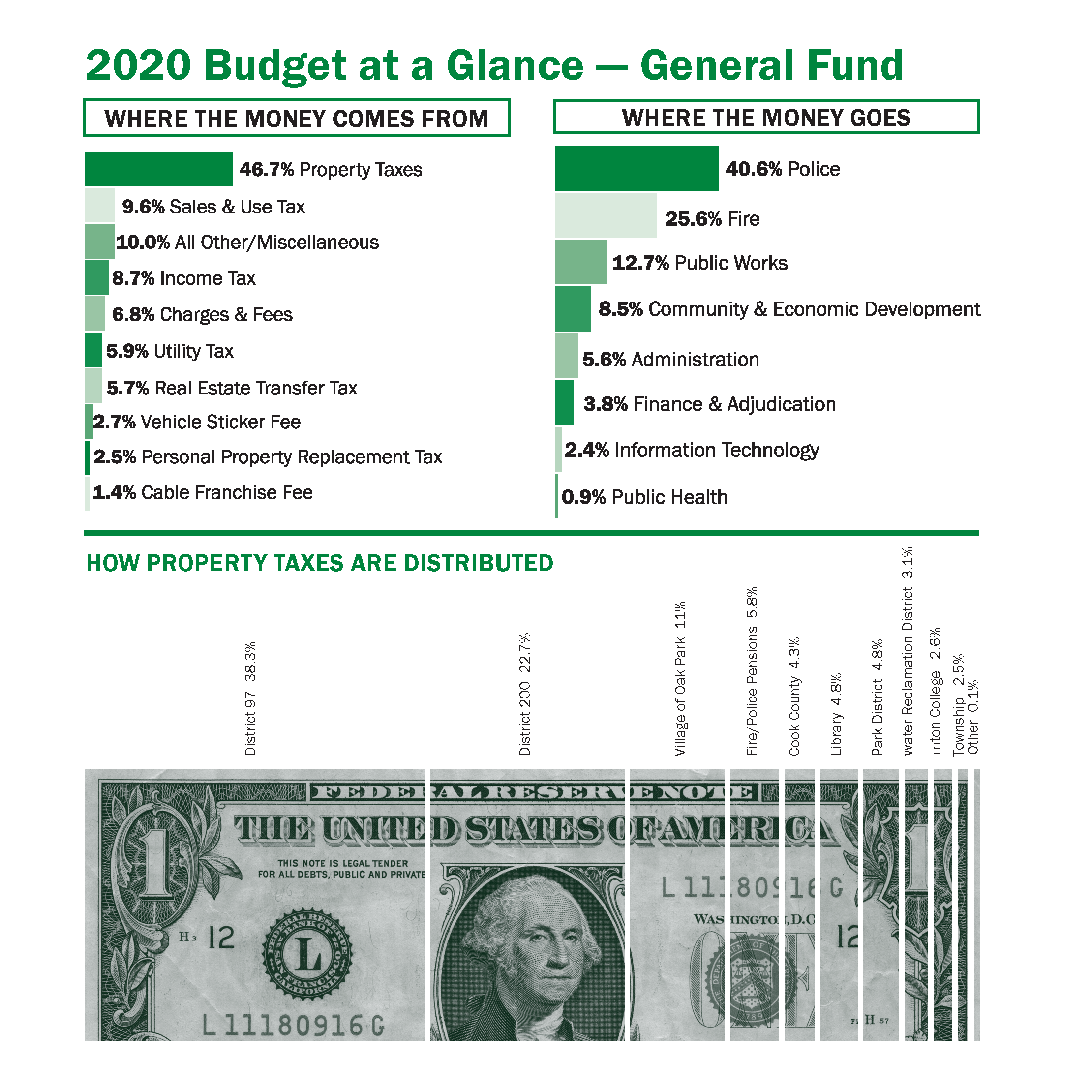

The budget’s $63.7-million general fund, which supports most day-to-day municipal operations, allocates nearly two thirds of all spending to the vital services provided by the Police and Fire departments. The men and women who fill these critical roles are on call around the clock, seven days a week, 365 days each year, responding to nearly 77,000 service calls in a typical year.

About 13 percent of all general fund expenditures will support the Public Works Department, whose workers maintain 100 miles of Village-owned streets, 500 alleys, 18,000 parkway trees, 7,000 lighting fixtures, 104 miles of water mains, 110 miles of sewer mains, eight miles of bicycle lanes and some 4,000 public parking spaces.

Municipal expenditures are supported by a number of sources including property taxes, sales taxes, user fees, utility taxes and real estate transfer taxes.

While property taxes will fund nearly 47 percent of general fund expenditures in 2020, only 11 percent of a local property owner’s tax bills goes to fund Village municipal operations. State-mandated Police and Fire pensions comprise an additional 5.6 percent of the Village levy.

Increases in some fees went into effect on Jan. 1, including waste collection for residential buildings with five or fewer units that are served by the Village’s waste hauling contractor.

The monthly cost for a 96-gallon refuse cart is now $28.35, up from $27.51, and the cost for a 64-gallon refuse cart is $25.75, up from $25. Refuse rates are charged on quarterly water bills. Green yard waste and pink bulk item stickers are now $3.10, up from $3.

Water rates rose to $9.81 per 1,000 gallons used, up from $9.52. Sewer rates, which are based on water use, are now $2.81 per 1,000 gallons of water used, up from $2.73. The majority of water and sewer fees cover the cost of purchasing Lake Michigan water from the City of Chicago, with a share also helping fund maintenance and improvements to the local water and sewer systems.

Revenue from a new fee is part of the 2020 budget — a 3 percent tax on recreational cannabis as allowed under state law. Proceeds from the cannabis tax have been earmarked for public safety programs.

Information on the budget process and copies of the FY2020 and past year’s budgets are posted at www.oak-park.us/budget.